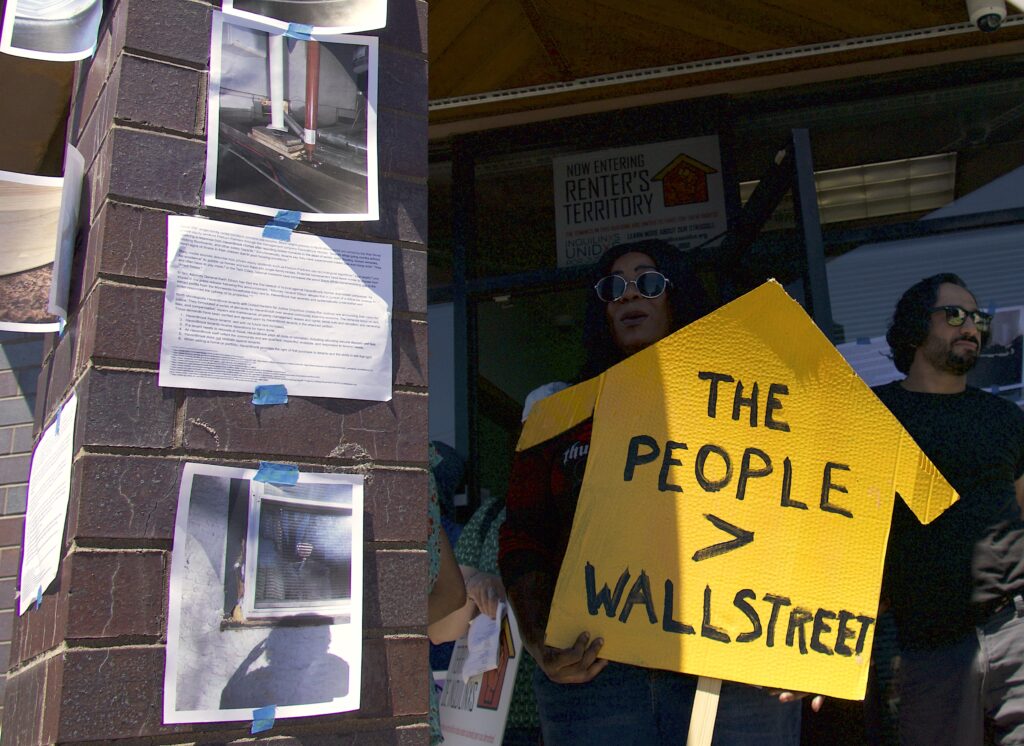

HavenBrook tenants and activists staged a rally outside the New Brighton office of property manager Progress Residential on June 17, 2022 to call on the company to address longstanding health and safety concerns with the homes they rent. Photo by Max Nesterak/minnesotadigest.com.

A new U.S. House report details how four corporate landlords resorted to aggressive and deceptive practices to force out tenants during the COVID-19 pandemic, violating state and federal rules aimed at keeping people in their homes during the public health emergency.

Together, the four corporate entities filed nearly 15,000 evictions against renters across the country in the first 16 months of the COVID-19 pandemic, despite state and federal eviction moratoriums, according to the report prepared by the House’s Select Subcommittee on the Coronavirus Pandemic, after a year-long investigation.

The corporate landlords — Pretium Partners, Invitation Homes, Ventron Management and The Siegel Group — continued filing evictions even as they recorded record profits and acquired thousands of properties thanks in part to money they received when Congress directed $46 billion to renters who lost income in the pandemic.

Pretium Partners, one of the largest private landlords in Minnesota, is currently being sued by Attorney General Keith Ellison for failing to maintain its properties and deceiving tenants with eviction threats during the moratorium.

Tenants at HavenBrook properties — now managed by Pretium subsidiary Progress Residential — also say the company has failed to address lead paint, mold, flooding and electrical problems, which have led to health problems for them and their children. Renters have withheld rent and staged a protest outside the company’s Minnesota office demanding repairs.

A spokeswoman shared a statement on behalf of Pretium saying the company never violated the eviction moratorium by the Centers for Disease Control and Prevention and “shares the goal of housing stability.”

Pretium’s ability to file evictions in Minnesota was tempered by courts refusing to process eviction filings except for a limited number of reasons, such as a tenant posing a physical threat to other residents.

The lawsuit brought by Ellison alleges Pretium, which owns more than 600 single family home rentals in the state, forced tenants out for non-payment of rent by threatening evictions and not renewing tenants’ leases, in violation of Minnesota’s eviction moratorium.

HavenBrook sent letters to tenants who were behind on rent saying they needed to pay within seven days or else move out. Otherwise, the company said it would file evictions against them and seek legal fees totaling $850 along with their deposits and unpaid rent.

The letter also told tenants that their credit scores would be hurt if they didn’t promptly pay back rent.

These letters were often enough to push renters to move without the company having to go to court, and Ellison’s office alleges they violated state laws against fraudulent and deceptive business practices.

According to the U.S. House subcommittee report, Pretium directed employees not to file evictions against tenants with pending rental assistance applications, but only if they had applied in the past 30 days.

Rental assistance was slow to reach renters and landlords, however. They often had to wait months for the federal aid to come through.

The delay was partly a function of a complex application process and the sheer size of the task falling on a state agency that had never before administered direct public assistance. Minnesota Housing, for example, created a new rental assistance program from scratch to distribute some $518 million, about 10 times as much as the agency’s annual budget.

According to the report, Pretium Partners also declined to accept rental assistance offers of less than $1,000 or less than 50% of a tenant’s rent, although it’s unclear from the report if this policy extended to Minnesota.

Invitation Homes, which also leases properties in the Twin Cities metro area, continued to file evictions against residents who had applied for assistance, according to the report.

In addition, Invitation Homes downplayed its eviction filings to creditors. Invitation Homes told Fannie Mae, the government-sponsored mortgage financing giant, in March 2021 that 6% of its evictions filings in the last six month resulted in residents losing their housing. But according to the company’s data, that number was 27%, according to the report.

The reports’ authors recommend that Congress take more precautions in future emergencies to protect renters by helping local agencies deliver aid more quickly and providing aid directly to renters in the case of uncooperative landlords.

The post U.S. House subcommittee uncovers thousands of pandemic evictions by corporate landlords appeared first on minnesotadigest.com.